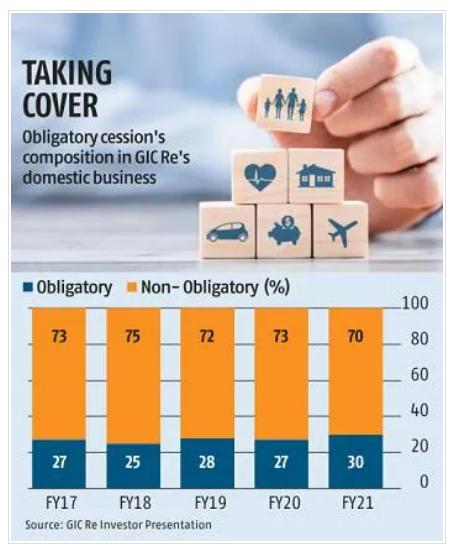

Obligatory cession refers to the part of the business that general insurers have to mandatorily cede to the national reinsurer, GIC Re

The insurance regulator has reduced the obligatory cession of each general insurance policy that is to be reinsured with state-owned Indian reinsurer GIC Re to 4 per cent starting from FY23. Earlier, the obligatory cession for each policy was 5 per cent.

“The percentage cession of the sum insured on each general insurance policy to be reinsured with the Indian re-insurer(s) shall be 4 per cent in respect of insurance attaching during the financial year beginning from 1st April, 2022 to 31st March, 2023, except the terrorism premium and premium ceded to nuclear pool, wherein it would be made ‘NIL’”, said the regulator.

Obligatory cession refers to the part of the business that general insurance companies have to mandatorily cede to the national reinsurer, GIC Re. Now, insurers have to cede 4 per cent of their premium on every general insurance policy sold to GIC Re. The insurance regulator decides on the percentage of obligatory cession every year.

“This decision may hit GIC Re but for the general insurers the impact of this will depend on whether they are able to get more reinsurance capacity for the extra risk. Insurers started looking for reinsurance capacity at 95 per cent because 5 per cent was automatic cession to GIC Re. Now, it will start at 96 per cent instead of 95 per cent. On an average around 50 – 70 per cent of the risk is reinsured by insurers, depending on the various lines of business”,

said a private sector insurer.

“The insurance regulator has been reducing the obligatory cession over time. Earlier it was 20 per cent, which came down to 15 per cent, and then to 5 per cent and now to 4 per cent. Slowly the regulator is making sure that the compulsory cession goes down and more reinsurers get into the market”, he added.

GIC Re may lose substantial revenue of about Rs 1,500 – 2,000 crore because of the reduction in obligatory cession, experts said.

Furthermore, the regulator has also fixed the percentage of commission on obligatory cession for each class of business. In the motor third party, oil and energy business there will be a minimum 5 per cent of commission, while it is 10 per cent in group health business, and 7.5 per cent in the crop insurance business. All other classes of insurance business will attract a minimum 15 per cent commission.

“Commission over and above, can be as mutually agreed between Indian re-insurer(s) and the ceding insurer”, the insurance regulator said.

As per Irdai regulations, the reinsurer, in this case GIC Re, has to share the profit commission, on a 50:50 basis, with the ceding insurer based on the performance and surplus of the total obligatory portfolio of the ceding insurer. However, no profit commission is payable if the loss ratio exceeds 78 per cent and profit commission shall not exceed 14 per cent, Irdai said.

Source Link :