It determines how much to produce and how to price a commodity, both important to get right for success.

We ask entrepreneurs and business owners this question all the time: “Have you reached the break-even point?” But you may not entirely understand the math behind the concept. Understanding the formula can only deepen your understanding of a business — here’s a closer look at how it works in reality.

A glass is half full or half empty depending on how you look at it, Break-Even Point (BEP) is no different. Simply put, a business reaches the Break-Even Point when business revenues exactly match the expenses incurred. Essentially, if you remain above the BEP, you earn profits, and if you go below, you lose.

This way, BEP helps businesses strategise and plan tactics to deal with variables such as — how much to produce in order to break even, pricing a commodity, ascertaining profitability levels, budget targets and the likes.

What is Break-Even Point ?

BEP is made up of two things — variable costs and fixed costs. Variable costs are directly proportional to revenue, and hence the name. For example, if the variable cost is ₹5 per unit and if 10,000 units are produced, then the total variable cost would amount to ₹50,000.

Fixed costs are costs that you incur irrespective of the production levels. Production could be zero, you still have to pay your fixed costs. It usually includes rent, employee salaries, and so on, which has no relationship with the revenue generated whatsoever. Bear in mind, the differentiation is only in the short to medium term. as it is possible to reduce fixed costs in the long run.

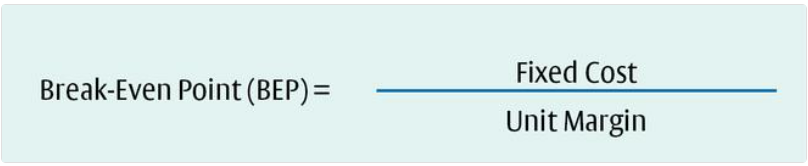

BEP is calculated by dividing the total fixed cost of production by contribution margin per unit. Here, contribution margin can be arrived at by subtracting the variable cost per unit from the selling price per unit. And BEP, in units, refers to the exact number of sales made that would make the revenue earned match with the corresponding expenses incurred.

From the way BEP is calculated, there are three ways to lower a break-even point — increasing the unit selling price of the product, reducing the variable costs, or reducing the fixed costs.

Profit to volume ration

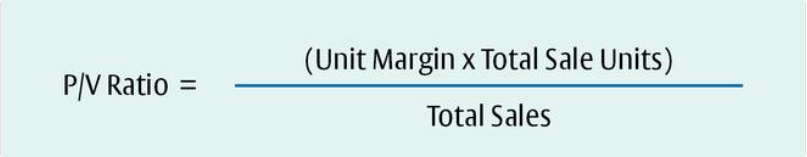

The profit to volume ratio (P/V ratio), which is the percentage of contribution to sales, is used to measure the profitability of a business

If there is a decrease in the selling price per unit, then the P/V ratio reduces, increasing the BEP and lowering MoS. Likewise, if the selling price per unit is increased, then the P/V ratio increases, lowering the BEP and increasing the margin of safety.

Given its capability, it would be interesting to determine what gives BEP such power. It is an effective tool that helps in ascertaining values of variables and helps the management make agile decisions in production and planning.

Usually, when the business takes off, it does not necessarily make any profit. It goes through some losses and expenses to make itself known to the public, as it is new on the block. So only when it finally breaks even and breaches the BEP, it starts to gradually turn in profits.

In order for the business to make profits, it must strive towards a lower break-even point. Baby steps, essentially. For such businesses , the BEP is a cold lemonade on a hot summer day because it means the business has started to grow.

Margin of Safety

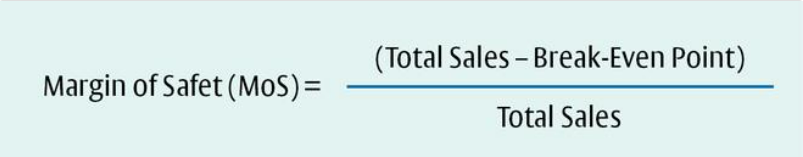

Margin of Safety (MoS) is the difference between the current sales and the break-even sales. If we arrive at a positive result, it means profit, and a negative result means loss. The bottomline is that the higher a business’s MoS is, the more financially sound the business.

It is said to be a safety net, especially in a prudently-run business. While BEP tells us the point where the revenues and expenses match, MoS is a point either beyond or below the BEP, indicating profit or loss. While MoS guarantees a cushion to fall back on, a Cash Break-Even Point makes sure that you don’t need such a cushion. A Cash Break-Even Point is exactly a point in sales where the business breaks even, and also reflect a positive cash flow.

One of the best applications of a break-even point is that it facilitates dynamic pricing. In an ever-changing market, the pricing strategies must be flexible enough to ensure that all expenditures are appropriately absorbed and market opportunities are explored and utilised. In dynamic pricing, the price of a commodity is periodically monitored and reviewed to adjust to the market conditions and consumer sentiments.

Business is about not losing money just as much as it is about making profits. Tools like BEP can be effectively used to monitor costs and make the organisation more agile in the market and fully exploit opportunities.

CH LALITHA KAVYA

(The writer is CMA Intern, RVKS And Associates, Chennai.)

Source File :

https://drive.google.com/file/d/1d91WY1cWGiEhcH1GZRfsFs2IizHnbDRI/view?usp=sharing

Source Link :