Introduction to Account Aggregator:

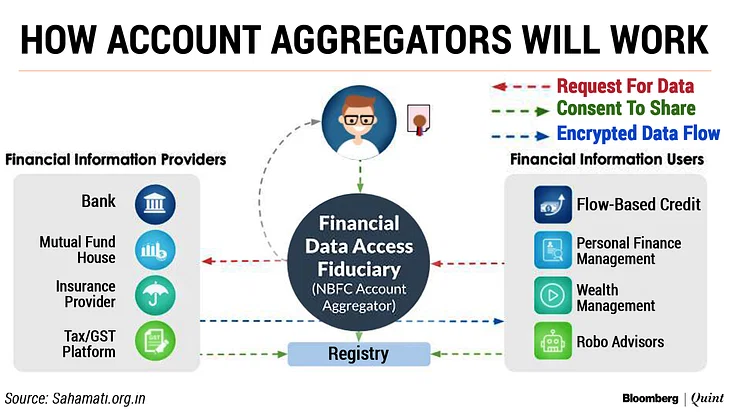

The Account Aggregator (AA) framework is an innovative initiative introduced by the Reserve Bank of India (RBI) with the primary objective of facilitating the seamless sharing of financial data. AA is a regulated entity that facilitates the secure and regulated sharing of financial data between financial information providers (FIPs) and financial information users (FIUs). FIUs uses that data to assess a consumer’s creditworthiness, provide better financial products and services.

AA framework aims at providing access to credit to the whole country. Thus, AA has potential to transform India from a prepaid economy to post-paid economy. AA ensures that data comes and goes to the right place, without itself accessing the data. Nandan Nilekani, non-executive chairman of Infosys, termed AA framework as “UPI moment for lending” which not just creates digital but a social transformation and inclusive growth.

Working of Account Aggregator Framework:

AA securely connects to one’s accounts with various financial institutions, namely banks or mutual funds called FIPs. With consent, AA aggregates the financial data which is held in multiple accounts in these FIPs. The account holder can see complete details, at a single place, with respect to their all-account balances, deposits, investments etc. Irrespective of where it is held, all at the same time. With explicit consent, AA securely retrieves financial information from these FIPs and delivers it to FIUs that require financial information to offer user financial services such as loans, insurance, or wealth management.

AAs thus acts like a bridge, to deliver financial data from FIPs to FIUs only based on consent.

Procedure for account opening and operation:

- Register with an AA either online (Website or mobile app) or offline and link the financial institution like bank, mutual funds etc.

- Apply for any financial service like loan or investment with any financial institution (FIUs).

- FIUs place a consent request to AA for financial data.

- AA presents the consent request for acceptance or rejection by user.

- If accepted, AA sends consent to FIPs.

- The data is received by AA in an encrypted form and the same is shared with FIUs.

- FIUs decrypts the data and sends it back to AA for account aggregation and analysis.

- AA sends the aggregated data to FIUs for real-time decision making.

List of account aggregators approved by RBI:

As on 31/03/2023, there are 9 AAs approved by RBI.

| Name of the company | Website |

| Nesl Asset Data Limited | https://www.nadl.co.in |

| Cams Financial Information Services Private Limited | https://camsfinserv.com/ |

| Finsec AA Solutions Pvt Ltd | https://www.onemoney.in/ |

| Cookiejar Technologies Private Limited | https://finvu.in/ |

| Dashboard Account Aggregation Services Pvt Limited | https://saafe.in/ |

| Perfios Account Aggregation Services Private Limited | https://www.perfios.com/ |

| Yodlee Finsoft Private Limited | https://yodleefinsoft.com/ |

| Phonepe Technology Services Private Limited | https://www.phonepe.com/ |

| CRIF Connect Private Limited | https://www.crifconnect.com/ |

Benefits of the AA Framework:

- Improved financial transparency: With an AA, one can see all his/her financial data in one place, including bank accounts, credit cards, investments, and loans helping to track spending, identify areas where money can be saved, and make better financial decisions.

- Increased convenience: With an AA, one can apply for loans, insurance, and investment products online without having to provide the same information to multiple lenders saving time and hassle.

- Secure, consent-driven, and reduced fraud: AAs use security measures to protect financial data, such as encryption, explicit consent and two-factor authentication reducing the risk of identity theft and fraud.

- Enhanced Financial Inclusion: The AA framework streamlines the accessibility of financial services for individuals and businesses, regardless of whether they possess conventional bank accounts as financial data is shared with FIUs, even in the absence of a direct association between the customer and FIU.

- Heightened Financial System Efficiency: By eliminating the need for paper-based documentation, the AA framework considerably speeds up obtaining financial information by reducing both time and cost associated.

Challenges of the AA Framework:

- Data Security: The effectiveness of the AA framework hinges upon the secure exchange of financial data between individuals, businesses, and authorized third parties. Inadequate protection of this data could potentially lead to its exploitation for fraudulent purposes.

- Consumer Education: Given the complexity of the AA framework, it is crucial that consumers must possess a comprehensive understanding of its functioning before divulging their financial data. In the absence of consumer awareness, there may be reluctance in utilizing the framework to its full potential.

- Regulatory Oversight: As a novel initiative, the AA framework necessitates the development of explicit rules and regulations by the RBI and other regulatory bodies. These regulations will ensure the legitimate use of the AA framework and safeguard consumer interests.

The NBFC – Account Aggregator (Reserve Bank) Directions, 2016, amended periodically, outline the regulations for AAs in India. To operate as an AA, a company must register with the RBI and meet minimum net owned fund requirements.

Conclusion:

The AA framework, though in its nascent stage, possesses the potential to revolutionize the Indian financial system by simplifying the sharing of financial data. AA framework has the capacity to bolster financial inclusion, mitigate fraudulent activities, and enhance overall efficiency in the financial domain. However, AA framework must confront challenges relating to data security, consumer education, and regulatory oversight. Proper regulatory guardrails is to be put in place to prevent misuse of data, mis-selling of financial products and predatory practices.

(This article is written by Balaji.K, Audit Executive at R V K S And Associates)