The CBDT has issued a circular pertaining to Sections 206AB and 206CCA of the I-T Act, which provide details regarding people to whom higher TDS/TCS rates should apply

Individuals who have not filed their income-tax returns (ITR) for 2020-21 (FY21) will now be on a list of non-filers prepared by the income-tax (I-T) department. Tax deduction at source (TDS) and tax collected at source (TCS) will be levied at a higher rate from such individuals with effect from April 1, 2022.

The Central Board of Direct Taxes (CBDT) has issued a circular pertaining to Sections 206AB and 206CCA of the I-T Act (introduced in Finance Act, 2021), which provide details regarding people to whom higher TDS/TCS rates should apply.

“The purpose of this circular is to bring more non-filers within the ambit of tax filers,” says Rohit Arora, advocate, Uttarakhand High Court.

Definition of specified person

According to the Finance Act, 2022, a ‘specified person’ is one who fulfils two conditions. The first is that this person did not file his ITR in the previous year.

Suresh Surana, founder, RSM India, says, “The previous year should be the one whose due date for return filing under Section 139(1) has expired.”

Surana further explains that earlier a higher TDS/TCS rate applied to persons who had not filed their returns for two previous years. Now, a higher rate will apply if a person does not file a tax return for one year.

The second condition is that the aggregate of TDS and TCS to be collected from this person should be Rs 50,000 or more in the previous year.

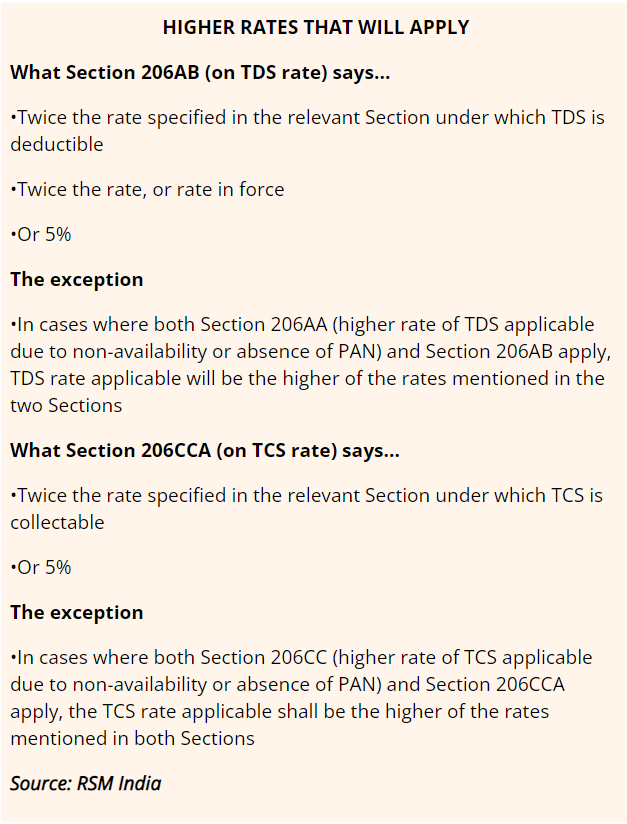

The higher rate that will apply will be double the prescribed rate or 5 per cent, whichever is higher.

Section 206AB and Section 206CCA

Section 206AB provides information on a higher TDS rate that will apply while making payments to a person on the list.

It does not apply to certain incomes and transactions.

Archit Gupta, chief executive officer, Clear, says, “It is not applicable to tax deduction on salary; premature withdrawal of Employees Provident Fund; winnings from a lottery, card game, or crossword puzzle; income for investment in a securitisation trust; winnings from a horse race; and cash withdrawals.”

Section 206CCA provides information on the higher TCS rate that has to be collected from a specified person.

Financial institutions can use the I-T department’s reference guide called ‘Compliance Check for Section 206AB and 206CCA’ to ascertain whether a higher TDS/TCS applies to a person.

The implications

A list of specified persons, on whom higher TDS/TCS rate will apply in 2022-23, has been prepared, taking FY21 as the relevant financial year. No new names will be added to this list during FY 2022-23.

Further, if the specified person files valid ITR (filed and verified) for FY 2021-22 (AY 2022-23), then his name will be removed from the list.

If the aggregate TDS and TCS does not exceed Rs 50,000 in the previous financial year, i.e., FY 2021-22, then also this person’s name will be removed from the list. This will be done on July 31, 2022.

What you should do

This circular will impact those who have not filed their returns.

Sandeep Bajaj, managing partner, PSL Advocates & Solicitors says, “Taxpayers should file valid returns for the financial year 2021-22 as this will remove their name from the list of specified persons. This removal will be done on the due date of filing of return of income for AY 2022-23 or on the date of actual filing of valid return (filed and verified), whichever is later.”

Surana adds, “Even belated and revised TCS and TDS returns of the relevant financial year filed during financial year 2022-23 will be considered for removing persons from the list of specified persons.”

According to Gupta, “Once the name is removed from the list, tax will be deducted at normal rates on transactions thereafter.”

Finally, as Deepak Jain, chief executive, TaxManager.in, says, “To even claim the excess TDS deducted, people will need to file their tax returns.”