Post office savings bank (POSB) account holders can use internet banking services provided by India Post, which is part of the Department of Posts (DOP). The Post Office Internet Banking can assist you in transferring funds between your own- and third-Party Post Office Savings Account, you can also deposit funds into your PPF and SSY accounts, along with many other services.

Pre-requisites for availing India Post Internet Banking

- According to the India Post website, the following are the conditions to be met before availing of internet banking services :

- Valid Active Single or Joint “B” Savings account standing at CBS Sub Post Office or Head Post Office.

- Accounts standing at Branch Post Office are not eligible for availing Internet banking facility.

- Provide necessary KYC documents, if not already submitted

- Valid unique mobile number

- Email address

- PAN number

How to register and activate for India Post internet banking

Step 1: Visit the nearest Post Office and fill out the form

(You will receive an SMS alert to your registered mobile number within 48 hours)

Step 2: Once you receive the SMS, go to the DOP Internet banking portal and click the “New User Activation” hyperlink on the home page.

Step 3: Enter Customer ID and Account ID (Customer ID is the CIF ID given on the first page of the savings account Passbook. Your savings account number is the Account ID).

Step 4: Fill in the required information and set your Internet Banking login and transaction passwords.

Note that login and transaction passwords cannot be same

Step 5: Now log in and set up your security questions and answers, as well as your password.

A ‘Pass phrase,’ which is a security add-on feature, may be requested. It verifies that you are accessing the correct DOP Internet Banking URL. It should be the same as the one you choose during user activation.

These procedures are required for your online banking user ID to be activated successfully.

Online transactions

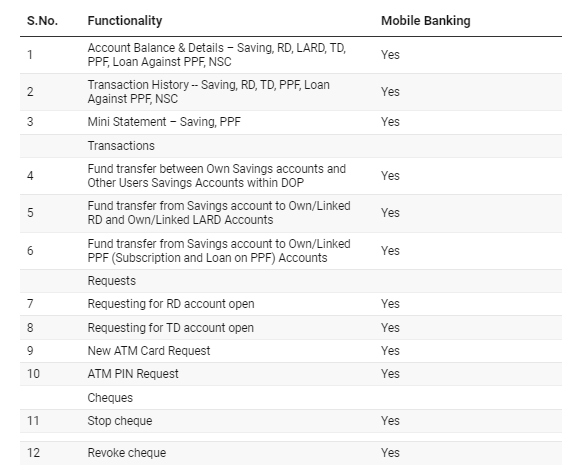

- Funds can be transferred from your POSB account to other POSB accounts belonging to you or a third party. Below are some of the transactions which can be done using internet banking.

- PPF Deposit and PPF Withdrawal

- RD deposit, Repayment of RD half withdrawal

- SSA deposit.

- RD and TD accounts can be opened through Internet Banking

- RD and TD accounts can be closed or pre-closed as per the existing POSB norms.

- Stop payment of cheque can be registered

- PPF withdrawal online

- Beneficiary can be added

- PPF Deposit and PPF Withdrawal

How to activate mobile banking

Fill out the mobile banking application and submit it. According to FAQs on the India Post website, “After registering for DoP Mobile Banking, download the India Post mobile banking app from Google play store and use the option Activate mobile banking and follow the pre-defined steps after 24 hours of registration.”

The CIF ID is printed on the first page of your passbook the default username. You can change your channel login credentials of mobile banking in the Update channel login ID option under My Profile section in internet banking.

Step 1: Download the Mobile Banking Application from the Google Play store

Step 2: Click on ‘Activate Mobile Banking’ tab

Step 3: Enter the Security Credentials and enter OTP

Step 4: After your activation has been authenticated, you will be prompted to inp ..

Now you are ready for login in DOP mobile banking app.

These services can be availed using mobile banking

Source File : https://drive.google.com/file/d/1MNixLPnib2c-OdAqP8R0tqzPFKV_zODf/view?usp=sharing