The Insolvency and Bankruptcy Code (IBC), which helped improve the credit culture in the country and made corporate rescue more dynamic, is set for another makeover. Mint takes a look at what is in store for the law.

The Insolvency and Bankruptcy Code (IBC), which helped improve the credit culture in the country and made corporate rescue more dynamic, is set for another makeover. Mint takes a look at what is in store for the law.

What impact has the IBC had so far?

The IBC came to existence in May 2016 as the earlier legal system under the Board for Industrial and Financial Reconstruction (BIFR) was much abused by shareholders of defunct firms to keep lenders from taking recovery action. It showed that defaulters will not only lose control of the companies, but will also be prevented from winning them back unless the dues are paid. The IBC’s operation has been marked by intense litigation involving promoters, lenders, and investors, some spectacular successes, and, in several cases, liquidation of firms. The code is set for another makeover.

What has necessitated the latest makeover?

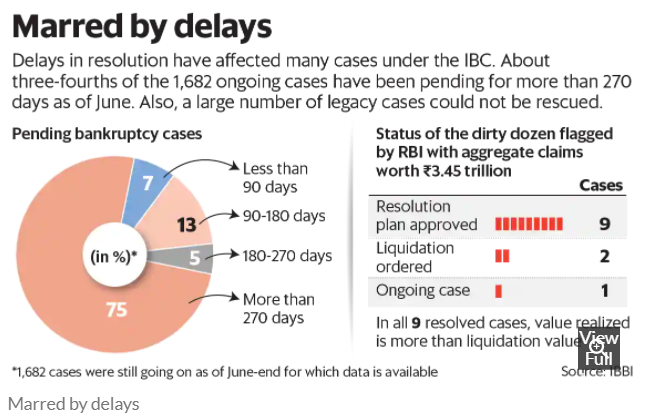

A large number of legacy cases could not be rescued. In many cases, delays proved to be inordinate as stakeholders fought lengthy court battles. About three fourths of the 1,682 ongoing cases were pending for more than 270 days as of June-end. The parliamentary standing committee on finance led by Jayant Sinha had in August flagged the steep haircut taken by lenders in many resolved cases and recommended a review of the IBC to see if it has served its purpose. Also, 47% of the 2,859 cases that were concluded were liquidated, though the 14% that got rescued accounted for three-fourths of the asset value in these cases.

At what stage is the IBC review currently?

The Insolvency and Bankruptcy Board of India (IBBI), the ministry of corporate affairs, and two consultative committees on company law and insolvency matters are working on amendments to the IBC. A bill to amend the code will be tabled in the coming budget session of Parliament. The IBBI has already made some changes to the bidding process for distressed assets.

What can one expect from the makeover?

The most important issue is the large haircuts in insolvency resolution, which can be attributed to either the lack of regulatory certainty over certain assets, the lack of appetite for the assets in the market, or the lack of marketing, said Anoop Rawat, partner at law firm Shardul Amarchand Mangaldas & Co. Delays in admission in tribunals also needs to be addressed. Experts are pinning hopes on automatic admission of bankruptcy petitions based on the record of default.

What is the future direction of the IBC?

The IBC has regularly been amended to rebalance the rights of stakeholders with competing interests, depending on the need of the hour. This trend is set to continue. In 2018, homebuyers were defined as financial creditors and later the payment default threshold to trigger bankruptcy action was raised from ₹1 lakh to ₹1 crore. The IBC is still developing and will have to be reviewed periodically over the next few years to bridge the gaps, said Yogendra Aldak, partner at law firm Lakshmikumaran and Sridharan.

Source File :

https://drive.google.com/file/d/1cYX3_ibepspkWf1miAQBEIog8h60dT_H/view?usp=sharing